Building Wealth. Preserving Freedom.

We help accredited investors grow their wealth through real estate syndications.

Why Real Estate Works - Especially Now

Smart investors are turning to real estate syndications for long-term cash flow, inflation protection, and generational wealth.

💸 Passive Cash Flow

Your investment generates monthly or quarterly income—without managing a property.

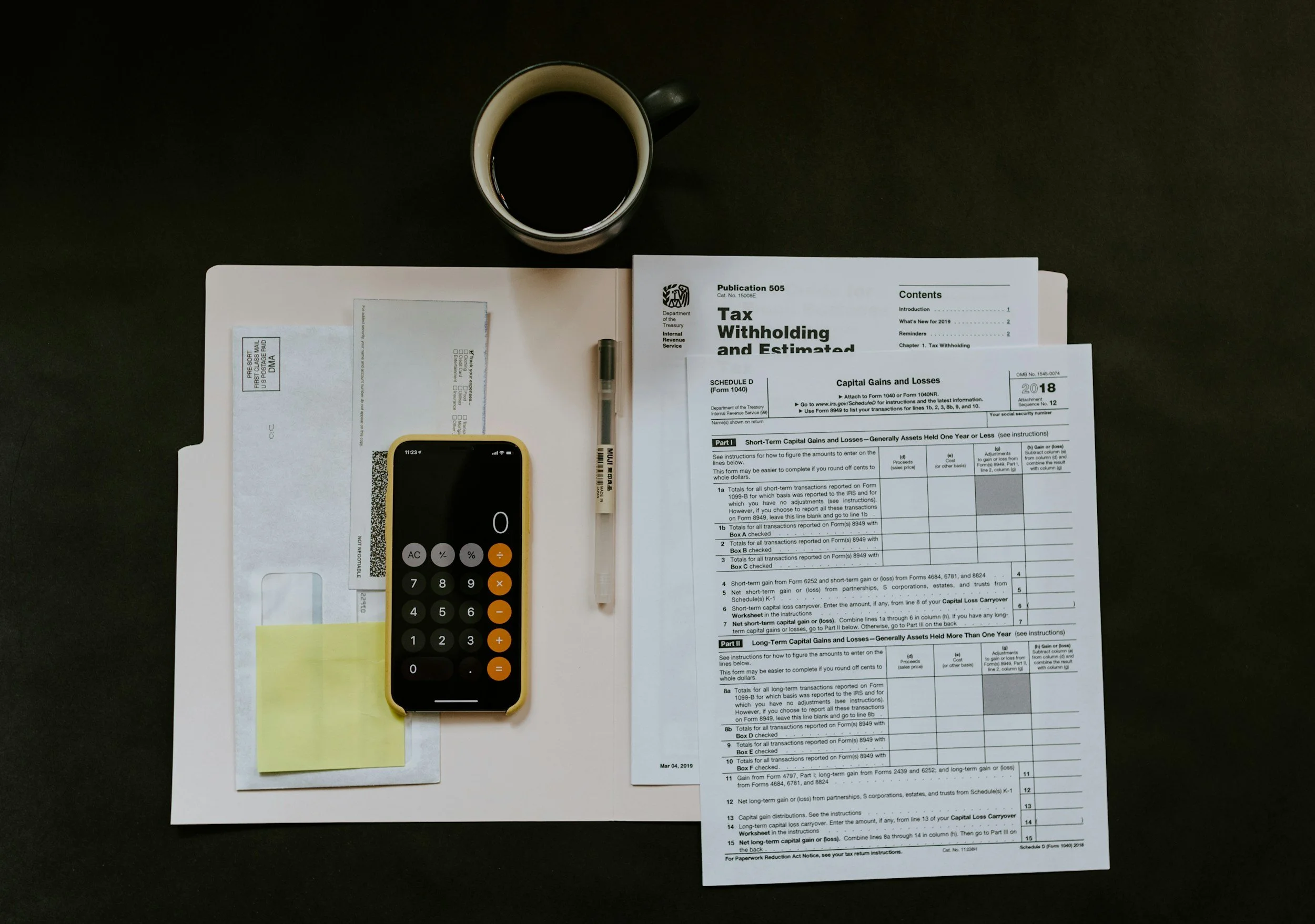

🏦 Tax-Advantaged Income

Depreciation and cost segregation help shelter your income from taxes.

📈 Inflation-Linked Growth

Rents tend to rise with inflation, while your debt stays fixed.

Why I Started Neely Property Investments

My dad ran his own business and often worked six or seven days a week to support our family. That gave me a front row seat to what responsibility looks like. But it also taught me something else:

Freedom doesn’t come automatically, even when you work hard.

As I built my own businesses, I was driven to find a different path. I didn’t just want income, I wanted time. Time for my family. Time to serve others. To build something lasting.

So I started reinvesting everything I could into commercial real estate.

It gave me what I was missing: cash flow, long-term growth, and freedom from trading my time for money.

Today, I help other investors do the same without having to buy the whole building or manage the property. Through syndications, you can access institutional-quality deals with real tax benefits, real cash flow, and real ownership, all without being a landlord.

This isn’t just about wealth. It’s about what wealth makes possible.

Let’s build that together.

Brent Neely, Founder

Neely Property Investments

How it works

Investing in real estate syndications doesn’t have to be complicated. Here’s what it looks like with Neely Property Investments:

Step 1: Join the Investor List

Get access to deals before they go public

Fill out a short form and confirm that you’re an accredited investor. You’ll receive our investor guide, deal previews and occasional updates.

Step 2: Review Investment Opportunities

We will share detailed pitch decks with underwriting, strategy, and returns.

When a new deal becomes available, you’ll get everything you need to evaluate it on your terms, no pressure, no hype.

Step 3: Invest and Receive Cash Flow

When you are ready, you can invest directly into the deal.

We handle the operations and reporting. You get passive income, equity growth, and a K-1 at tax time.

What You Get as an Investor

-

Real Ownership, Without the Hassle

You own equity in institutional-grade real estate, but we handle the management, financing, and operations.

-

Cash Flow While You Sleep

We target assets that generate stable monthly or quarterly income from day one.

-

Tax Advantages You Can Actually Use

Through depreciation and cost segregation, your K-1s often show a paper loss—even while you’re collecting income.

-

Clear, Transparent Communication

You’ll receive regular updates, financials, and personalized service from a real person—not a fund rep.

Stay in the Loop. Build Smarter.

Join our email list for real-world investing insights, deal updates, and proven strategies to grow and protect your wealth through real estate.